Currency strength is often misunderstood in Africa. A strong currency doesn’t necessarily mean a country is richer or more developed; it simply reflects how much value one unit of a currency holds against the U.S. dollar.

Using that measure, here’s a breakdown of Africa’s 10 strongest currencies as of January 2026, why they rank so highly, and why Nigeria’s naira is notably absent from the list.

1. Tunisian Dinar (TND) — Tunisia

The Tunisian dinar remains Africa’s strongest currency by exchange value, trading at under 3 dinars to the dollar. Its strength is largely driven by strict currency controls, which tightly regulate access to foreign exchange and limit speculation. While Tunisia faces economic challenges, the central bank’s tight grip on the dinar has helped preserve its nominal value, even when broader economic indicators suggest fragility.

2. Libyan Dinar (LYD) — Libya

Despite years of political instability, the Libyan dinar continues to rank among Africa’s strongest currencies. Libya’s oil-driven foreign exchange inflows play a major role here, providing the central bank with dollar liquidity to support the currency. Like Tunisia, Libya operates a managed FX system, meaning the dinar’s strength is less about market confidence and more about controlled supply.

3. Moroccan Dirham (MAD) — Morocco

Morocco’s dirham reflects a more balanced story. Backed by a diversified economy; spanning manufacturing, agriculture, tourism, and exports to Europe, the dirham benefits from relative macroeconomic stability. Morocco has gradually liberalized its exchange regime without allowing sharp volatility, helping the dirham maintain steady strength against the dollar.

4. Ghanaian Cedi (GHS) — Ghana

Ghana’s presence in the top four is notable given its recent debt restructuring and IMF-backed reforms. The cedi’s ranking reflects currency redenomination history and monetary restructuring, rather than pure economic dominance. While the cedi has experienced sharp swings in recent years, policy tightening and external support have helped stabilize its nominal value enough to keep it among Africa’s strongest by unit value.

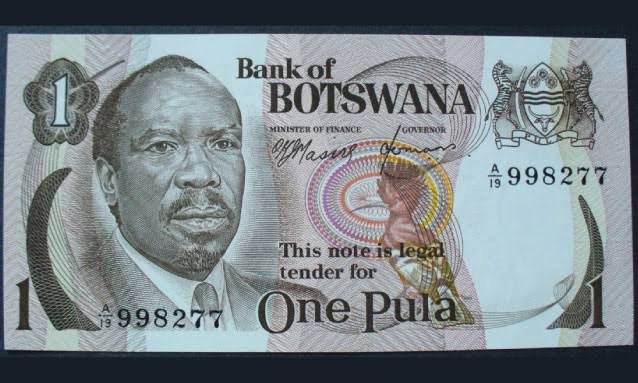

5. Botswana Pula (BWP) — Botswana

Botswana’s pula is one of Africa’s most respected currencies, supported by strong institutions, prudent fiscal management, and diamond exports. The country’s conservative monetary policy and low public debt have made the pula relatively stable over time. Unlike many peers, Botswana has avoided extreme FX volatility, reinforcing confidence in its currency.

6. Seychellois Rupee (SCR) — Seychelles

Seychelles’ rupee ranks high largely due to the country’s tourism-driven foreign exchange earnings. With tourism accounting for a significant share of GDP, steady inflows of dollars and euros help support the rupee. While the economy is small, its openness and reliance on foreign visitors give the currency a consistent FX lifeline.

7. Eritrean Nakfa (ERN) — Eritrea

The Eritrean nakfa’s strength is almost entirely policy-driven. Eritrea operates one of Africa’s most tightly controlled economies, with fixed exchange mechanisms and limited currency convertibility. As a result, the nakfa’s nominal value remains high; though this does not necessarily reflect market demand or economic openness.

8. South African Rand (ZAR) — South Africa

Africa’s most traded currency, the rand earns its place through deep financial markets and global liquidity, not tight controls. While the rand is volatile and sensitive to global risk sentiment, South Africa’s advanced banking system, capital markets, and export base help prevent extreme devaluation compared to many peers.

9. Lesotho Loti (LSL) — Lesotho

The Lesotho loti is pegged one to one with the South African rand, meaning it mirrors the rand’s movements almost exactly. Its ranking here is therefore less about Lesotho’s domestic economy and more about its monetary union with South Africa, which provides currency stability and predictability.

10. Namibian Dollar (NAD) — Namibia

Like Lesotho, Namibia’s dollar is also pegged to the South African rand, ensuring parity in value. This peg helps Namibia maintain currency stability, benefit from South Africa’s financial infrastructure, and avoid the FX shocks seen in more isolated economies.

Where Is Nigeria’s Naira?

Nigeria’s naira does not feature anywhere near Africa’s strongest currencies list.

As of late 2025 and early 2026, the naira traded around ₦1,400–₦1,500 to the U.S. dollar, placing it among the weaker currencies on the continent by exchange value.

Nigeria’s currency struggles reflect structural FX challenges, not economic irrelevance. Persistent dollar shortages, high inflation, heavy import dependence, and long-standing FX market distortions have weighed heavily on the naira. While recent reforms have improved transparency and reduced volatility, they haven’t yet translated into a stronger nominal exchange rate.

Some of Africa’s strongest currencies exist in tightly controlled or small economies. Meanwhile, larger economies like Nigeria and Egypt operate weaker currencies shaped by market forces, trade deficits, and reform cycles.